PayPal Holdings, Inc. - Common Stock (PYPL)

40.42

+0.52 (1.30%)

NASDAQ · Last Trade: Feb 8th, 7:10 PM EST

Detailed Quote

| Previous Close | 39.90 |

|---|---|

| Open | 40.25 |

| Bid | 40.38 |

| Ask | 40.45 |

| Day's Range | 39.38 - 40.61 |

| 52 Week Range | 38.88 - 79.50 |

| Volume | 34,921,700 |

| Market Cap | 37.19B |

| PE Ratio (TTM) | 7.471 |

| EPS (TTM) | 5.4 |

| Dividend & Yield | 0.1400 (0.35%) |

| 1 Month Average Volume | 26,429,309 |

Chart

About PayPal Holdings, Inc. - Common Stock (PYPL)

PayPal Holdings is a leading digital payments platform that enables individuals and businesses to make and receive payments electronically. The company provides a secure and convenient way to conduct transactions online and through mobile devices, allowing users to link their bank accounts, credit cards, and debit cards to their PayPal accounts. With a focus on enhancing the user experience, PayPal offers a range of services including online money transfers, payment processing for e-commerce, and digital wallet solutions, empowering users to manage their finances and engage in global commerce seamlessly. Read More

News & Press Releases

Large-cap losers last week (Feb. 2–Feb. 6) were hit by weak earnings/guidance and analyst downgrades—led by Stellantis, Gartner, PayPal, Reddit, and Novo Nordisk.

Via Benzinga · February 8, 2026

The leader in electronic payments is struggling to get back to its pandemic highs.

Via The Motley Fool · February 7, 2026

Two companies battling to win the global payments market.

Via The Motley Fool · February 6, 2026

PYPL Stock Has Shed 30% Over Past 10 Sessions – So Why Is Retail Still Bullish?stocktwits.com

Via Stocktwits · February 6, 2026

PayPal Stock Is Almost Back To Where It Started — Now Just 9% Above 2015 IPO Pricestocktwits.com

Via Stocktwits · February 6, 2026

PayPal Faces Wall Street Wrath As Analysts Slash Price Targets; Retail Calls PYPL ‘Bruised’stocktwits.com

Via Stocktwits · February 5, 2026

SNAP, BSX, PYPL Stocks Hit 52-Week Lows — But Refuse To Stay Down After-Hoursstocktwits.com

Via Stocktwits · February 4, 2026

Enrique Lores' experience running a computer hardware maker just might be an unexpected asset at PayPal.

Via The Motley Fool · February 6, 2026

Investors should be prepared for a different type of bull market.

Via The Motley Fool · February 6, 2026

We live in an era of momentum investing. Value investing – especially deep value investing – is out of fashion. As a result, nobody is interested in PayPal.

Via Talk Markets · February 6, 2026

Buy now, pay later company Affirm (NASDAQ:AFRM) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 29.6% year on year to $1.12 billion. Its GAAP profit of $0.37 per share was 39.5% above analysts’ consensus estimates.

Via StockStory · February 5, 2026

Curious about which S&P500 stocks are generating unusual volume on Thursday? Find out below.chartmill.com

Via Chartmill · February 5, 2026

The era of "big data" has officially transitioned into the era of "actionable AI," and no company embodies this shift more prominently than Palantir Technologies (NYSE: PLTR). As of February 5, 2026, Palantir has evolved from a secretive, Silicon Valley outlier into a cornerstone of the S&P 500 and a primary engine for both national [...]

Via Finterra · February 5, 2026

Glancy Prongay Wolke & Rotter LLP, a leading national shareholder rights law firm, today announced that it has commenced an investigation on behalf of PayPal Holdings, Inc. (“PayPal” or the “Company”) (NASDAQ: PYPL) investors concerning the Company’s possible violations of the federal securities laws.

By Glancy Prongay Wolke & Rotter LLP · Via Business Wire · February 4, 2026

Nancy Pelosi sold PayPal stock before the company's latest earnings report and CEO change announcement.

Via Benzinga · February 4, 2026

Which S&P500 stocks have an unusual volume on Wednesday?chartmill.com

Via Chartmill · February 4, 2026

A new platform helps nonprofits save thousands on fees while managing volunteers, fundraising, HR, and more, all in one place.

Via Press Release Distribution Service · February 4, 2026

PayPal Holdings Inc (NASDAQ:PYPL) didn't lose because the world moved too fast — it lost because it chose safety while the world was being rebuilt.

Via Benzinga · February 4, 2026

PayPal's Q3 earnings miss & CEO change due to 'execution challenges' led to downgrades & lowered price targets from analysts. Shares decline further.

Via Benzinga · February 4, 2026

Via Benzinga · February 4, 2026

Executives of big tech firms have taken to X to shed light and give insights into PayPal’s disappointing run over the past few years.

Via Stocktwits · February 4, 2026

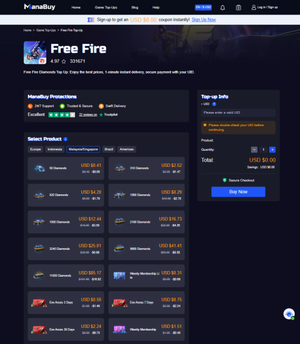

ManaBuy’s 2026 platform update enhances the Free Fire top-up experience with a faster purchase flow, clearer order tracking, improved local-currency checkout in select markets, quicker delivery after payment verification, and more competitive deals—while keeping transactions safer by fulfilling via the player’s UID without requiring passwords.

Via Binary News Network · February 4, 2026

AI Panic Hits Software, PayPal Faceplants, Walmart Joins the $1T Clubchartmill.com

Via Chartmill · February 4, 2026

Former CEO David Marcus slams PayPal's "lost soul" and "defensive" strategy as stock plunges 20% on stagnant 1% growth and CEO shake-up.

Via Benzinga · February 4, 2026

Digital payments platform PayPal (NASDAQ:PYPL) fell short of the markets revenue expectations in Q4 CY2025 as sales rose 3.7% year on year to $8.68 billion. Its non-GAAP profit of $1.23 per share was 4.5% below analysts’ consensus estimates.

Via StockStory · February 4, 2026