News

Edgewell (EPC) Q1 2026 Earnings Call Transcript

Via The Motley Fool · February 9, 2026

This could give you a much larger lifetime benefit.

Via The Motley Fool · February 9, 2026

Move stress-free across Melbourne. Our best-rated team boasts 600+ glowing reviews and offers packing, storage and same-day moves. Book now.

Via GlobePRwire · February 9, 2026

These two dividend stocks could keep raising their payments annually for years to come.

Via The Motley Fool · February 9, 2026

Via Talk Markets · February 9, 2026

A lot of attention is being directed to the exciting things happening in the world of commerce.

Via The Motley Fool · February 9, 2026

These dividend stocks are worthy of income investors' attention.

Via The Motley Fool · February 9, 2026

March S&P 500 E-Mini futures (ESH26) are down -0.25%, and March Nasdaq 100 E-Mini futures (NQH26) are down -0.46% this morning, pointing to a lower open on Wall Street as rising Treasury yields curbed investors’ risk appetite.

Via Barchart.com · February 9, 2026

Could Dow 60,000 be around the corner?

Via The Motley Fool · February 9, 2026

The AI revolution is just getting started.

Via The Motley Fool · February 9, 2026

Retail sentiment remained bearish on the SPDR S&P 500 ETF (SPY), while sentiment on the Invesco QQQ Trust (QQQ) slipped to neutral from bullish last week on Stocktwits.

Via Stocktwits · February 9, 2026

Banks use their capital and expertise to help businesses grow while offering consumers essential financial products like mortgages and credit cards. Furthermore, economic conditions have supported loan growth and fee income,

a trend that has enabled the banking industry to return 20.3% over the past six months.

At the same time, the S&P 500 was up 6.6%.

Via StockStory · February 8, 2026

Bitcoin and altcoins bounced modestly, but bearish sentiment, elevated liquidations, and macro uncertainty suggest the move reflects short-term relief rather than a durable trend reversal.

Via Stocktwits · February 9, 2026

Bitcoin has been falling fast recently, but the token has still delivered lifechanging returns for buy-and-hold investors over the last decade.

Via The Motley Fool · February 8, 2026

January jobs report releases Wednesday with CPI data Friday. Cisco, Coca-Cola, McDonald's, Robinhood, and Coinbase report earnings this week.

Via Talk Markets · February 8, 2026

Three tailwinds could lift this sector when the new Fed Chair makes his mark.

Via The Motley Fool · February 8, 2026

Via Benzinga · February 8, 2026

Markets face a critical week featuring an unusual mid-week jobs report Wednesday at 8:30am alongside Friday's January CPI data, creating a compressed economic data schedule that will test whether recent inflation concerns are justified or if price pr...

Via Barchart.com · February 8, 2026

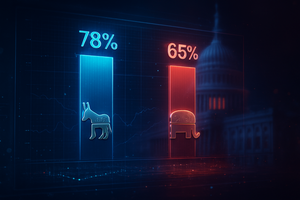

The landscape of political forecasting has shifted beneath the feet of Washington insiders and retail traders alike. As of February 2026, the "Grand Relaunch" of PredictIt has officially transformed the platform from an embattled academic experiment into a fully regulated powerhouse known as the Aristotle Exchange. By shedding its restrictive "no-action" status and adopting a [...]

Via PredictStreet · February 8, 2026

The precious metal hit a new all-time high in January, only to end up crashing later on.

Via The Motley Fool · February 8, 2026

You always get what you pay for, so don't be afraid to pay up for a little more quality.

Via The Motley Fool · February 8, 2026

Knowing how you're doing compared to the average American doesn't tell you as much as you might think.

Via The Motley Fool · February 8, 2026

Retirees should brace themselves for both positive and negative changes to Medicare this year.

Via The Motley Fool · February 8, 2026

Wall Street's foremost financial institutional has transformed from Wall Street's bedrock to a stock market liability.

Via The Motley Fool · February 8, 2026

The bond market is speaking more loudly than the stock market about the likely direction of the Federal Reserve.

Via The Motley Fool · February 8, 2026