Latest News

These stocks are making the most noise in today's session.chartmill.com

Via Chartmill · March 4, 2026

Morgan Stanley says these banks will be net beneficiaries of AI.

Via Barchart.com · March 4, 2026

You might not view electric vehicle maker Rivian as an AI investment, but look closer and you'll see why you should.

Via The Motley Fool · March 4, 2026

Brown-Forman slid despite a quarterly beat as investors focused on a cautious fiscal 2026 outlook and continued category headwinds.

Via Benzinga · March 4, 2026

Via Talk Markets · March 4, 2026

Meta goes all-in on AI: From new shopping tools and infrastructure groups to $50M news deals. Is $META stock a buy during the dip?

Via Benzinga · March 4, 2026

Bitcoin (CRYPTO: BTC) is trading above $73,000, up 13% since U.S.

Via Benzinga · March 4, 2026

Software stocks are bouncing. IGV has risen every day this week. Dan Niles says history suggests more upside — even without a confirmed bottom.

Via Benzinga · March 4, 2026

On Holding reported upbeat Q4 earnings but shares tanked on conservative guidance. Analysts remain bullish.

Via Benzinga · March 4, 2026

Dan Crenshaw lost his bid to remain in Congress in the Texas Republican primary. His stock portfolio is doing just fine though, with several 100% gainers.

Via Benzinga · March 4, 2026

Via Talk Markets · March 4, 2026

Via Talk Markets · March 4, 2026

Curious about which S&P500 stocks are generating unusual volume on Wednesday? Find out below.chartmill.com

Via Chartmill · March 4, 2026

These two biotechs have a lot in common. Their differences are even more pronounced.

Via The Motley Fool · March 4, 2026

Semtech has acquired HieFo, a manufacturer of laser devices for data center interconnects. Semtech stock is near record high territory.

Via Investor's Business Daily · March 4, 2026

Explore how LQD’s broader bond mix and TLT’s Treasury focus shape risk, yield, and diversification for fixed income portfolios.

Via The Motley Fool · March 4, 2026

Abercrombie & Fitch reported Q4 earnings beat but shares fell due to margin pressure and softer outlook. Tariffs may add $40M in costs.

Via Benzinga · March 4, 2026

Anavex Life Sciences' stock rises despite no news, up over 40% this year as investors watch Alzheimer's program updates and analyst targets.

Via Benzinga · March 4, 2026

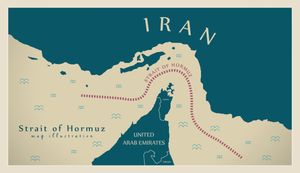

Is the Iran war a reason to change your investing strategy?

Via The Motley Fool · March 4, 2026

War-related news is powering another big move for Palantir stock.

Via The Motley Fool · March 4, 2026

Investors are trading GOOGL call options in heavy volume today, showing, for the most part, they are very bullish on Alphabet. GOOGL is down over 11.5% from its pre-earnings release peak, a great opportunity for value investors.

Via Barchart.com · March 4, 2026

Coca-Cola and S&P Global are both stable long-term income investments.

Via The Motley Fool · March 4, 2026

Forge Global lists five late-stage companies, nicknamed "soonicorns" that have the potential to quickly reach unicorn status.

Via Benzinga · March 4, 2026

The BDC now has an even higher dividend yield.

Via The Motley Fool · March 4, 2026

Lean hog futures are rallying on Wednesday, with contracts up $1.50 to $1.75 on the day. USDA’s national base hog price was not reported on Wednesday morning due to light volume. The CME Lean Hog Index was 15 cents higher on March 2 at $89.84. USDA’s...

Via Barchart.com · March 4, 2026

The wheat complex is posting losses across most contracts at midday. Chicago SRW futures are down 6 to 7 cents at midday. KC HRW futures are slipping 6 to 7 cents at midday. There were 91 deliveries issued against March KC wheat overnight. MPLS spri...

Via Barchart.com · March 4, 2026

Soybeans are showing most contracts within a penny of unchanged, with front month March down 1 ¾ cents. There were another 244 deliveries issued overnight. The cmdtyView national average Cash Bean price is down 3/4 cent at $10.97 3/4. Soymeal future...

Via Barchart.com · March 4, 2026

Corn futures are down 2 to 4 cents across most contracts on Wednesday. There was just 1 delivery issued against March corn overnight. The CmdtyView national average Cash Corn price is down 4 cents to $4.02 3/4. USDA reported another private export s...

Via Barchart.com · March 4, 2026

Live cattle futures are posting $3.60 to $4 across most contracts. Cash trade has yet to be reported so far this week. Wednesday morning’s Fed Cattle Exchange online auction showed no sales on the 1,224 head, with bids at $238. Feeder cattle futures...

Via Barchart.com · March 4, 2026

Cotton futures are up 20 to 25 points in the front months on Wednesday. Crude oil is up $0.52 on the day to $75.08. The US dollar index is back down $0.191 at $98.815. The Seam showed sales of 6,789 bales sold on 3/3, averaging 62.49cents/lb. The Co...

Via Barchart.com · March 4, 2026

Secret Iran Outreach Please click here for an enlarged chart of SPDR S&P 500 ETF Trust

Via Benzinga · March 4, 2026

Ross Stores jumped after a strong quarterly beat and upbeat guidance signaled durable off-price demand and continued momentum into the new year.

Via Benzinga · March 4, 2026

Morgan Stanley (NYSE:MS) is expanding its crypto footprint, filing an S-1 with the U.S.

Via Benzinga · March 4, 2026

SES AI stock is trading higher on Wednesday. Investors are looking forward to the company's fourth‑quarter earnings release after the close.

Via Benzinga · March 4, 2026

KALA BIO (KALA) shares rose after unveiling a strategic initiative to build an on-premises AI infrastructure platform for biotech.

Via Benzinga · March 4, 2026

The CEO just bought over a $1 million worth of shares.

Via The Motley Fool · March 4, 2026

The artificial intelligence (AI) neocloud provider announced a big deal.

Via The Motley Fool · March 4, 2026

Via MarketBeat · March 4, 2026

These stocks should continue to provide value for Berkshire Hathaway and other investors.

Via The Motley Fool · March 4, 2026

As oil surges on Middle East tensions, airline ETFs slide while energy funds gain —fueling a tactical long-energy, short-airlines trade.

Via Benzinga · March 4, 2026

As part of the partnership, Crossmint plans to integrate with Western Union's Digital Asset Network and support access to USDPT within its existing wallet and payment APIs.

Via Stocktwits · March 4, 2026

Ondas Holdings (NASDAQ:ONDS) shares up on news of $20 million purchase order for autonomous border protection system, aligned with positive market trend. Stock trading above SMAs, RSI neutral, MACD bearish. Analysts rate it a Buy with $13.06 price target.

Via Benzinga · March 4, 2026